how to calculate sales tax in oklahoma

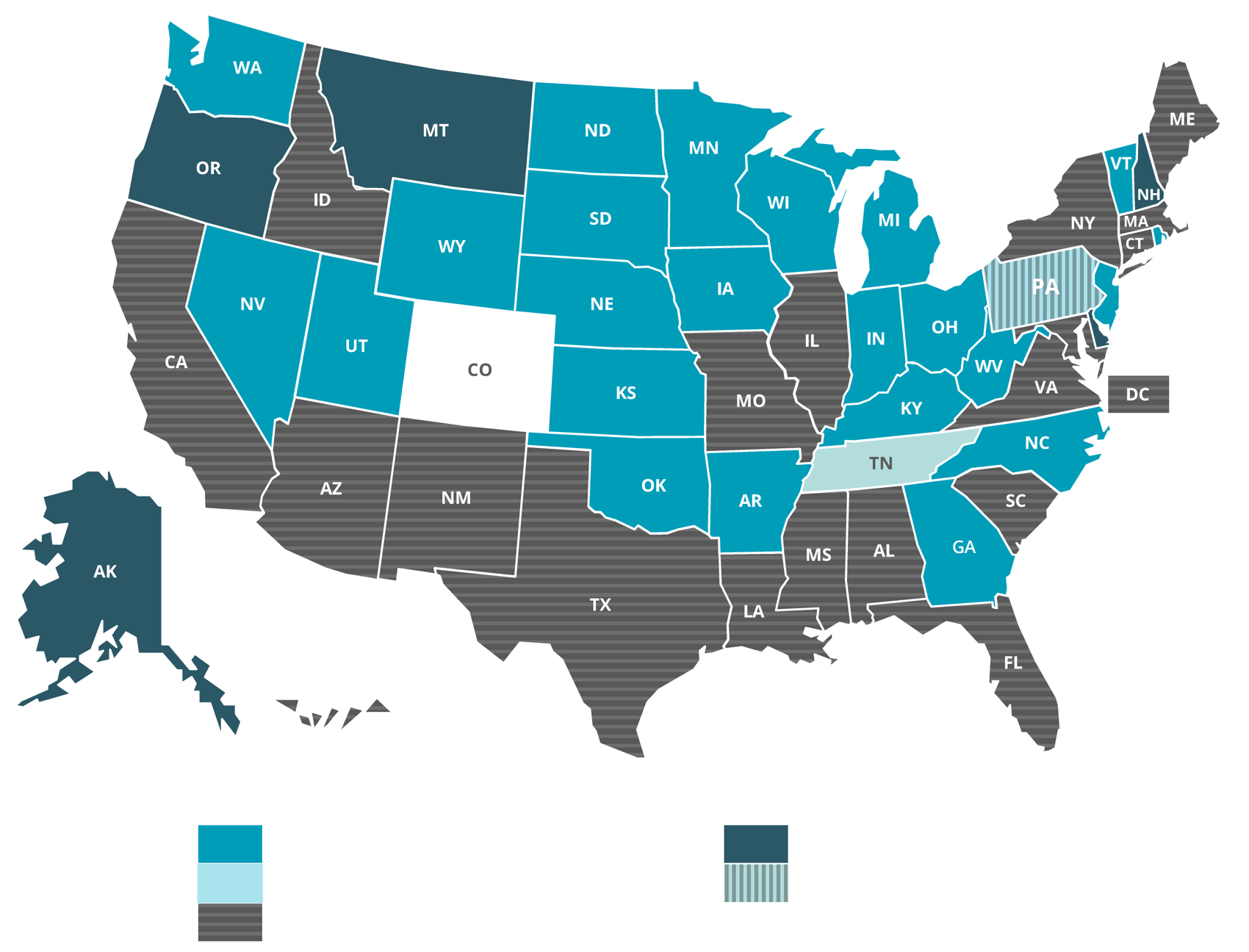

Use tax is calculated at the same rate as sales tax. Oklahoma State Tax Quick Facts.

Sales Tax Laws By State Ultimate Guide For Business Owners

To use our Oklahoma Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

. In Oklahoma this will. Ad A brand new low cost solution for small businesses is here - Returns For Small Business. Depending on local municipalities the total tax rate can be as high as 115.

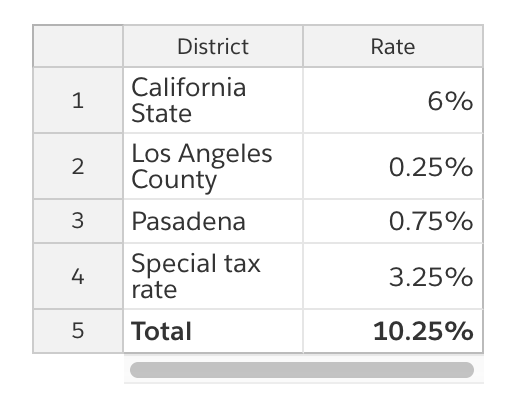

Since this varies by city and county use the state sales tax rate of 45 045 plus the applicable city andor county rates. Enter an amount into the calculator above to find out how what kind of sales tax youll see in Oklahoma County. The oklahoma city sales tax rate is 8625 taxing jurisdiction rate oklahoma state sales tax 450 oklahoma city tax 413 combined sales tax.

Item or service cost x sales tax in decimal form total. 325 of taxable value which decreases by 35 annually. Minus Tax Amount 000.

Minus Tax Amount 000. How To Calculate Oklahoma Sales Tax On A New Car. The calculator will show you the total sales tax amount as well as the.

In Oklahoma this will always be 325. To know what the current sales tax rate applies in your state ie. Enter an amount into the calculator above to find out how what kind.

Before Tax Amount 000. Just enter the five-digit zip. This takes into account the rates on the state level county level city level and special level.

If you do not. Enter an amount into the calculator above to find out how. Other local-level tax rates in the state of Oklahoma.

Plus Tax Amount 000. The equation looks like this. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles.

Thats where you need a Sales Tax Calculator like ours which will keep you at ease fully satisfied. The excise tax for new. Multiply the vehicle price after trade-ins.

Multiply the cost of an item or service by the sales tax in order to find out the total cost. Plus Tax Amount 000. The Oklahoma state sales tax rate is 45.

However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way. The Oklahoma OK state sales tax rate is currently 45. Ad A brand new low cost solution for small businesses is here - Returns For Small Business.

You can use our Oklahoma Sales Tax Calculator to look up sales tax rates in Oklahoma by address zip code. Plus Tax Amount 000. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

Typically the tax is determined by. 325 of ½ the actual purchase pricecurrent value. Local tax rates in Oklahoma range from 0 to 7 making the sales tax range in Oklahoma 45 to 115.

If you are based in Oklahoma and selling to a buyer with a ship to address in Oklahoma charge sales tax based on the sales tax rate at the ship. 087 average effective rate. The average cumulative sales tax rate in the state of Oklahoma is 771.

The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price. 19 cents per gallon of regular gasoline and diesel. To calculate the sales tax on your vehicle find the total sales tax fee for the city andor county.

The base state sales tax rate in Oklahoma is 45. After a few seconds you will be provided with a full. Minus Tax Amount 000.

Before Tax Amount 000.

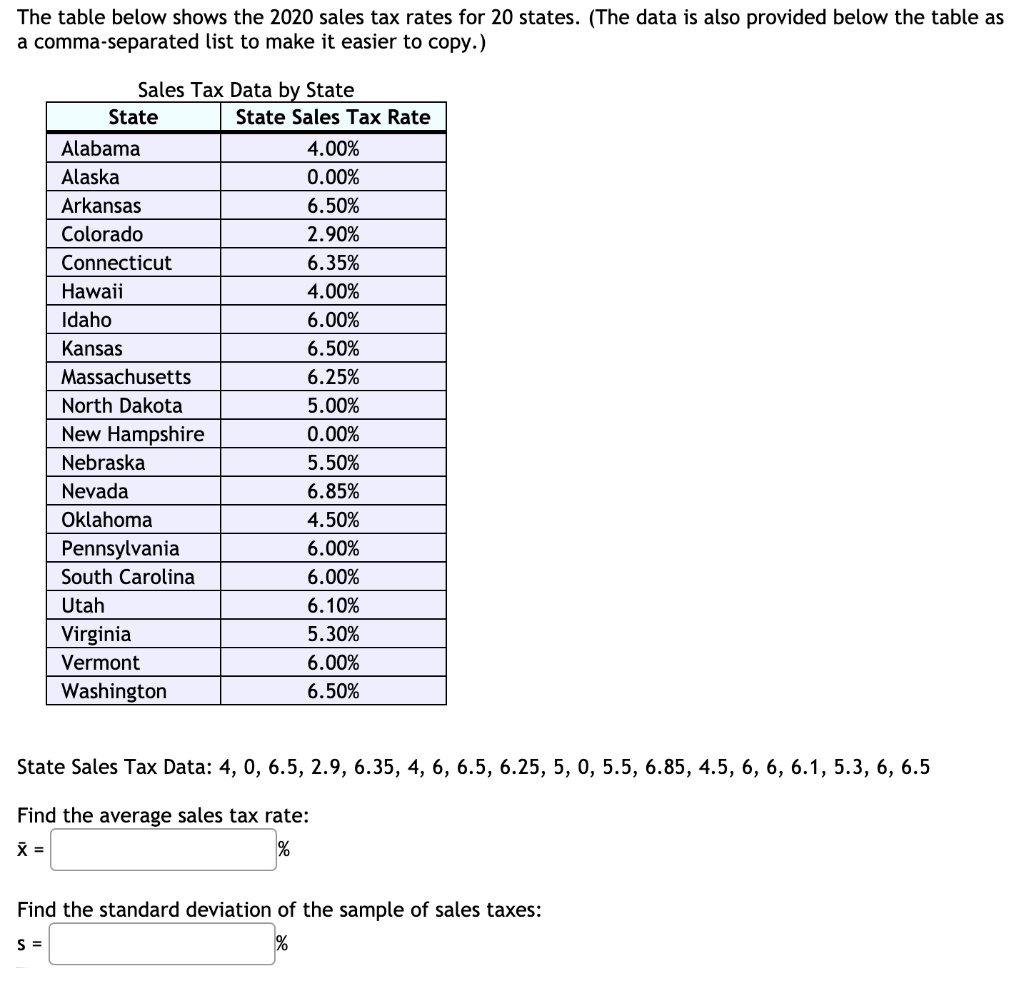

Solved Could You Help Me Figure Out What The Average Sales Chegg Com

Amazon Fba Sales Tax Made Easy A 2022 Guide

Oklahoma Sales Tax Handbook 2022

How To Calculate Sales Tax Definition Formula Example

Pennsylvania Sales Tax Guide For Businesses

When Will Your City Feel The Fiscal Impact Of Covid 19

Pdf Strategic Fiscal Interdependence County And Municipal Adoptions Of Local Option Sales Taxes

Pull Factors A Measure Of Retail Sales Success Estimates For 77 Oklahoma Cities 2018 Oklahoma State University

Online Sales Tax In 2022 For Ecommerce Businesses By State

Llc Tax Calculator Definitive Small Business Tax Estimator

Beginner S Guide To Dropshipping Sales Tax Printful

How To File And Pay Sales Tax In Oklahoma Taxvalet

How To Calculate Sales Tax For Your Online Store

How To Register For A Sales Tax Permit In Oklahoma Taxvalet